The businessman thinks that only profit increases their business value. Though they hardly think that one of the basic things in the calculation is fixed assets. Building, land, equipment, furniture, and machinery are a common example of fixed assets. A fixed asset is a critical element to calculate the value of your business.

In this situation, you don’t know the value of asset the financial accounting will be incomplete and it won’t provide you with the real position of your business.

What is a fixed asset?

A fixed asset is a long-lasting part of the business that has used in the age of its income and isn’t foreseen that would be eaten up or devoured into money in coming next one year. In the typical situation of a fixed asset are a maker’s plant assets, for instance, its structures and equipment. “Fix” shows that these benefits won’t be sold in the present accounting year.

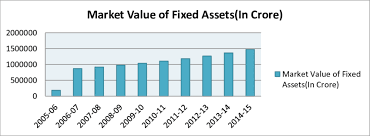

Value of Fixed assets

In the company documentation to understand the financial health the organisation estimate and add the capital in its financial statements. To utilise the potential financial specialists the data includes depreciation and fixed assets when they want to know whether the company is profitable or non-profitable. The depreciation policy must be considered when they decide to calculate the life of a fixed asset. The value of the fixed assets depreciates when it’s used. Fixed assets are joint with the asset report at their basic expense also, after that depreciation all through their life until they are sold, replaced on the bookkeeping report at their leftover regard.

Fixed Assets in Accounting

On the off chance that your business has a fixed asset, sound accounting measures can fill in as a manual for appropriately speak to these whole deal products on your accounting records. Specific trades that impact money to join the purchase, revaluation, degrading and clearance of the benefit. This exchange is essential to the precision of your business’ financial records and reports.

A turnover ratio of Fixed Asset

Fixed assets turnover extent is an action extent that estimates how adequately an association is utilizing its fixed assets in creating income. The financial specialists use this condition to perceive how well the company is utilizing their gadgets and equipment to deliver deals. This thought is basic to budgetary authorities since they need the ability to check a precise benefit for their endeavor.

Check out this formula;

Aggregate Fixed Asset = Fixed Assets – Total Depreciation

Fixed Assets Turnover Ratio =Net Revenue / Aggregate Fixed Assets

Where Net Revenue =Gross Revenue – Sales Return

Types of Fixed Asset

There are two main types of fixed assets, tangible and intangible assets.

Tangible Assets

The tangible assets are based on these incorporate things such as equipment, furniture, fixtures, building, vehicles, land and many more. All those visible assets that you think they maintain your business. Start with that what you gained or rented them for then fit the depreciation strategies to reduce their value. But some fixed assets are not depreciated like land. It is considered the same value in the balance sheet.

Intangible Assets

The intangible assets are incorporated on the licenses, trademark name, goodwill, and even the phone numbers. Any innovation which is a plan to sell is also included in the intangible assets. Goodwill is an intangible asset and this type of assets generally calculate with finding the difference between the company actual cost and the cost that which is sold and purchased. The intelligible assets are difficult to calculate.

Conclusion

So many businessmen have no idea about their company worth so they are just guessing then after some time they faced mystery costs. Though it is important to understand the value of your assets that are run your business. This is very important advice for the accountant first calculate the value of the fixed asset by following depreciation strategies. Fixed assets played an important role in the business and also provide relaxation over the year.

Author Bio

Ronald Willey has retired from formal education and research in HE but now he is spending time in writing help and research contributions to student use of a computer in fieldwork and also provide the best assignment help in UK.