Mold claims are often linked to the damage caused by water, as both are quite related in terms of cause and effect. Maintaining a positive outlook for the treatment of mold is essential to get rid of this problem. Taking the help of a professional mold treatment company can be the best approach to treat the problem. These companies provide with crucial tips that can be applied to reduce the chances of the occurrence of mold. They can also help you with services like water proofing of the roof and the walls.

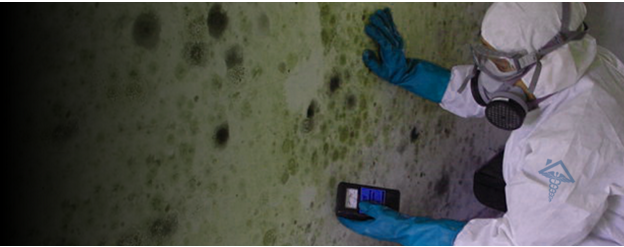

Professional mold treatment

The professional mold treatment companies use chemicals, machinery and advanced remedial methods to give a permanent or at least a long lasting solution to the mold problem. In the early 2000’s the insurance companies were flooded with the claims involving mold claims and had to resolve to limit coverage for the mold treatment claims. The most common figure that most companies set was between $1000 to $2000.

Mold is feared by home almost all the homeowners.

Nobody would like to see their prized possession being ruined by bacteria and fungus. Not only the mold causes serious health issues but it also affects the strength of the establishment. Mold develops in moist conditions and can spread throughout the structure if proper care and steps are not taken. It has to be resolved and the places where the mold is maximum have to be treated to remove persistent moisture.

People have many questions while they are looking for remediation process for the mold as it involves heavy costs. Another concern for mold treatment which gives rise to many queries is because of the long duration of the process. Insurance is a fine solution to the monetary concerns but then it depends on whether the source of the mould is covered under the policy or not.

Mold exclusions are mostly part of the homeowner’s insurance policy

Mold exclusions are mostly part of the homeowner’s insurance policy and even if the policy does not cover the mold treatment it does not mean that your claim will be denied automatically.

Many policies have certain molds enlisted other than that if any mold occurs; it prevent the policy holders to claim for the damage. Such claims are denied in the case where mold occurs on the sites that are exposed to high humidity or repeated water leaks that are often not given the required remedial treatment.

Molds that arrive due to an accident are covered

Molds that arrive due to an accident are covered under all the policies and you get the claim that you deserve after inspection. Take an example, if the pipe bursts due to any reason and the water discharged by it creates the mold. In such a case you will be eligible to claim for compensation from the insurance company as the reason for your claim will be the burst pipe and the not the mold. Homeowner’s insurance attorneys can consult for advice if the claims are denied in a case where the policy make you eligible to claim for the mold.

Therefore you need to be aware of what the policy provides and what it does not. Take help of an expert attorney for the purpose may serve well and help you in clearing your doubts