The numeric history of your credit score is referred to as cibil score. The approval or rejection of applications of loan that you have applied for depends solely on this important factor. Most financial institutions and banks depend on these scores for evaluating the potential risk impersonated by lending money to borrowers. Not only borrowers can now quickly secure their credit but can also support loan providers for managing their operations effectively. The maintenance of a proper credit history is highly important for increasing your credit score.

Looking at the Factors

Some factors are taken into account for calculating cibil scores. Having knowledge about the factors makes it easier for you to improve cibil score. The payment history of a borrower, the kind and number of loan accounts, outstanding debt and span of the credit history of a borrower are few of the factors that hold importance. Upon the calculation of the scores, these are sent to the financial institutions for assessment purposes. All the credit institutions and banks have their own standard that determines a good score. It is again different for banks.

Availing Loans Easily

When availing loan approvals is concerned, cibil scores play a highly vital role. Your creditworthiness will be determined by it that will again help you to access loans quickly. A plethora of tips is available by which you can improve cibil score. For instance, not having a credit history is equal to zero credit score to lenders. But you can solve this issue by creating a fixed deposit account after which you can apply for a credit card against the account. The credit score can be largely upgraded by making consistent payments on the card.

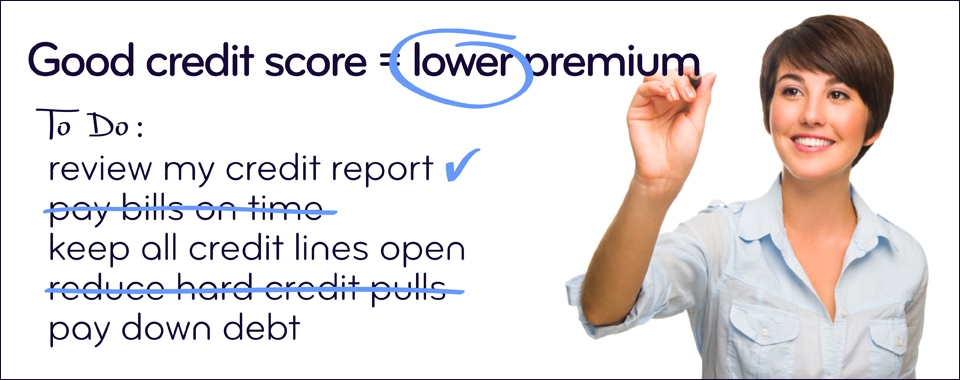

Shaping the Financial Journey

Your financial journey largely gets affected by your credit score for which it is important that you find various methods to increase cibil score. However, even without a score, you can avail credit, but then you have to borrow from untrustworthy lenders with high rates of interest. A proper credit score will offer you with the finest terms and interest rates. If your score is high, only then you will obtain low-interest rates. Also by this, you can save a substantial amount of cash. Some reputed credit management companies have emerged that help borrowers to maintain a good credit score.

Some of the Advantages

To search various ways to increase cibil score, you also need to realize the benefits a good credit score. Firstly, easy approval for leased and rented apartments is possible. Secondly, when opting for car and home loans, you will need to pay low rates of interest. Thirdly, it is possible to receive sanction for higher limits in the context of credit cards. Fourthly, security deposit on various cell phones is no longer needed.